Governor Murphy Announces Package of Support for NJ Entrepreneurs Affected by SVB Crisis

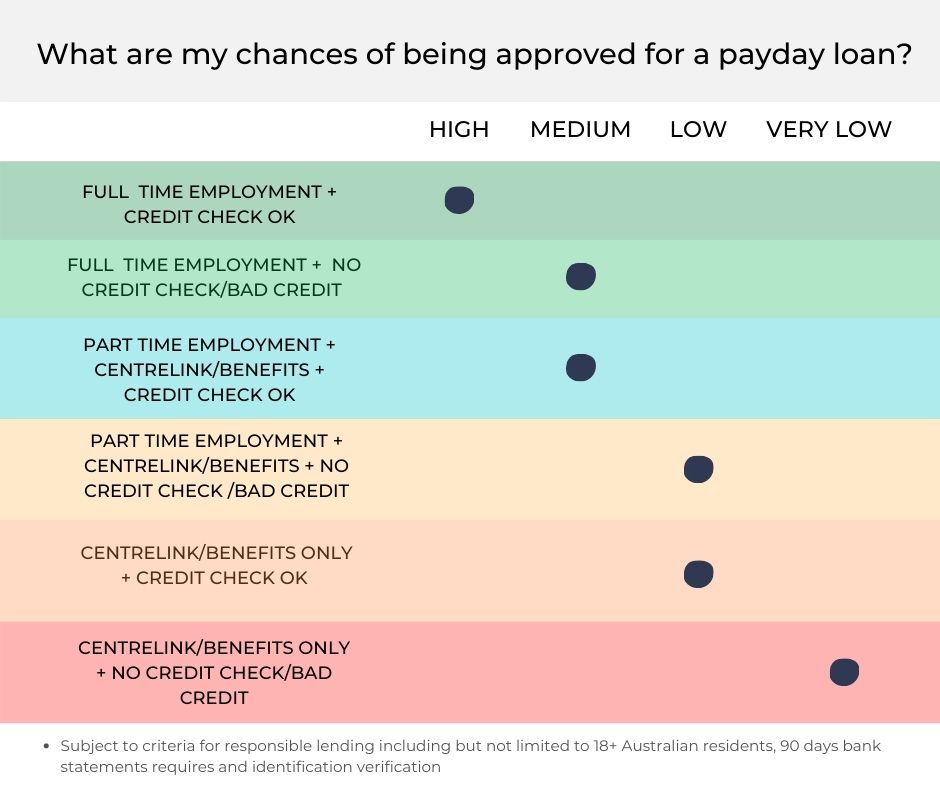

Good to Go Loans Pty Ltd © 2019, , Sydney, Australia Australian Credit Licence 439808 ACN 160232422. You will get a quick loan approval decision. Monthly interest capitalisation. You may also have the option to consolidate debt from credit cards and repay the debt with less interest. The main difference between an installment loan and revolving credit is the number of payments. Still, it’s best to get any agreement in writing, and consider bringing in a third party to act as a witness. Zespół HR przygotował dla nas super zabawę, w której mogliśmy się poznać i jednocześnie zwalczyć strach przed otwartym mówieniem do publiczności. Possible Finance has installment credit or loans that are repaid back over two months in multiple paychecks. Home buyers must fulfil a number of standards. In addition, MoneyMutual offers competitive interest rates and flexible repayment terms. Payday loans are short term loans that offer quick cash to help you bridge the gap between paychecks. Our award winning editors and reporters create honest and accurate content to help you make the right financial decisions. This means that you do not have to give the lender any collateral or borrow against a valuable item as you do in a pawn shop. The Financial Ombudsman’s website has information on how to make a complaint about payday lenders. That’s why we’re bringing the issue directly to voters this November. In those situations, a portfolio loan might be the right answer. CashLady Representative 49. All it takes is a few minutes. Finding yourself unable to repay your loan on time could affect your credit score and interest may be added. Those with a history of poor credit may be declined by high street and online lenders who use automated processes to assess applications for borrowing. In some cases, that might be true, but 48% of payday loans are renewed multiple times, according to the Consumer Financial Protection Bureau CFPB, indicating that the majority of these loans are not paid off on time.

14 Must Have Digital Marketing Tools

If you do not qualify for a federal loan, it is most likely because you do not have difficulty paying for college in the first place. A typical two week payday loan with a $15 fee for every $100 borrowed equals an APR of almost 400 percent, according to the Consumer Financial Protection Bureau. In collecting or attempting to collect a motor vehicle title loan, a motor vehicle title lender is required to comply with the restrictions and prohibitions applicable to debt collectors contained in the Fair Debt Collection Practices Act, 15 USC ∮ 1692 et seq. Our broker has done everything we can to make the process as efficient as possible. Common uses of these loans include paying rent, EMIs, and living expenses. You take out a small, short term loan and repay it when you receive your next paycheck. With much more reasonable rates than cash advance lenders, a PayDay Loan is your best choice when you just can’t wait until payday. Montana voters passed a ballot initiative in 2010 to cap loan rates at 36 percent annual interest, effective in 2011. Uk/enCompare our loans at AllTheLenders. Opting for a longer tenure would also mean that you will be paying a higher interest over the loan tenure. Remember, a credit search is designed to protect you as much as the lender, so that you can avoid unnecessary financial difficulty from borrowing more than you can afford.

Oportun

Need some help completing your application form or just want to chat about your loan with us. And that void has been filled by better lenders who can comply with the law, still make a profit, and serve low income people more fairly. This website is just a platform for linking borrowers and lenders. For help, go to moneyhelper. As responsible lenders, we assess your personal financial requirements to provide an affordable loan solution to suit your individual needs. These documents are designed to help you take over the finances of someone who is incapacitated. Unlike credit cards with revolving credit — which you Fast Approval Funds use, repay and repeat for long periods — you use an installment loan once, usually to finance a large purchase. Get a response in 60 seconds. As you can see, Low Credit Finance is a godsend for people struggling to make ends meet because you can borrow the money you need and get it in your bank account the same day. Refer to full borrower agreement for all terms, conditions and requirements. It will likely be months before borrowers learn the outcome of the case, but there’s a deadline of sorts. When considering business loan eligibility, the lender is likely to expect evidence of how much money your business makes under recent and normal trading conditions. Under TILA, your lender is compelled to make sure you’re aware about the full cost of the products or services they offer. That’s not the case here. Some companies won’t always pay you on your first payday — especially if you haven’t done a full month of work beforehand. Personal loans made through Upgrade feature Annual Percentage Rates APRs of 8. We’ll ensure you won’t be kept waiting, leaving you with more time to put your new funds to good use and settle an unexpected or emergency expense fast. The quickest and safest way to get an online payday loan is to complete your request – you guessed it online. We are purchasing the home for the fair market value so it just kind of sucks that we get punished for it. Access your account 24 hours a day via the online portal. If approved, we’ll transfer the funds to your bank account without delay using the Faster Payments System, which means you could receive your loan the same day as approval where possible, if your bank supports this. Starting with one store, she grew the business to over 50 storefronts offering payday loans. For additional information, please visit. Payday advances are not recommended as long term financial solutions. For those who remove payday effortless lending often, they start constructing a pitfall that spirals their financing spinning out of control.

Woodstock

Overview: If your credit score makes it difficult to get approved for a loan, LendingClub allows you to increase your chances of approval by having a co borrower. As trust and profit grow, previously cash constrained micro entrepreneurs can obtain loans under better terms and conditions, which itself fuels further business expansion. We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. You can set up convenient weekly payouts through the various methods available to receive compensation for the traffic you generate. For more information and further details, please contact our Phone Banking Service at 080022099 Toll Free Number using a local landline, and at +962 6 5658011 for calls from outside / inside Jordan. There are plenty of credit check websites available today that allow you to check your credit score for free. Rocket Mortgage, 1050 Woodward Ave. Federal credit union cap rates for personal loans at 18%. This comparison rate is based on our personal loan for an amount of $30,000 over 5 years, a $495 establishment fee and a $10 monthly fee. A $1,000 loan is a short term cash advance that gives you the necessary money fast. And it is always preferable to take into account the costs a brand levies during the loan transaction to prevent any misunderstandings in the hereafter. And it could take you over your overdraft limit, leading to bank charges.

NZ OWNED AND OPERATED

Cease and Desist Order; hearing; judicial review; enforcement; violation; penalty. Your customer must be eligible for the scheme and be successful with their application in order to qualify for a £200 referral fee. If the payday lender does not believe it has violated the law, it can cash the customer’s check. The digital lending models are–. Our step by step process is easy to apply for online. Because these loans are often a last ditch option for borrowers with poor credit, payday loans tend to carry significantly higher interest rates than traditional personal loans and can come with a plethora of hidden fees. If you are having the payday loan money automatically deducted from your bank account, ask the bank to stop the automatic deduction. MoneyMutual’s easy loans for bad credit are tailored to meet the needs of those with bad credit, ensuring that they can get the money they need without having to worry about their credit score. Fortunately, there are specific services created to help you compare and select from multiple lenders in minutes. You’ll pay back a total of $424 in three monthly payments of approximately $141. After connecting with your prospective mortgage lenders, understanding their business style and reputation, it’s time to focus on the numbers. Requires no documentation. Here is a list of our partners and here’s how we make money. This strategy focuses on paying off debts with the smallest balances first. Paying your monthly bills seems like a great way to earn more rewards. Accessible Version Return to text. CommBank acknowledges the Traditional Owners of the lands across Australia as the continuing custodians of Country and Culture. When it comes to “lock or float,” your own personal outlook and comfort with risk is likely to be the determining factor. Your loan amount will be determined based on your credit, income, and certain other information provided in your loan application. However, it never hurts to ask your supervisor if this is possible. Once approved, you can drawdown cash from your available credit limit. Furthermore, they also have a user friendly website and offer fast loan processing, making it an ideal choice for those who need quick access to funds. While I cannot tell you when your credit score will improve, make sure you make timely monthly payments. Here are some of the key benefits to keep in mind. At Bankrate we strive to help you make smarter financial decisions. If Your Application Is Successful, You’ll Receive The Funds The Same Working Day. Consolidation means moving debt from multiple accounts to just one account, ideally with a lower interest rate. Ignorance of the existence of the Privacy Policy will not be an acceptable excuse for non compliance. Repayment terms are 8, 12, 15 or 24 months. Under the law, there’s a cap on most payday loan fees.

About UPI Web Collect and QR Code:

We’ll always agree on all your loan costs upfront and never charge any extra or hidden fees. This means creating and executing a formal loan document that includes the amount borrowed, the interest rate, specific repayment terms based on the projected cash flow of the start up business, and collateral in case of default. Phase 5: Check the APR and Fees. There are dozens and dozens of options out there for private student loans, which, to be honest, can make the process of choosing the right ones stressful. Eastern time to potentially get the funds the day you’re approved. That was fine with us, as it saved us money. Cash rewards are forfeited if your Card is closed before redemption. Most police departments in Canada have a department dedicated specifically to cases of fraud, identity theft, and other financial crimes. If you don’t want to wait that long or can’t meet those qualifications, B9 and Cleo are the next most affordable options, with a $100 cash advance costing $9. Someone has to pay for the work brokers do and, if the broker is not charging the consumer who is looking to borrow, it probably means they are charging the direct lender who will be providing you with credit. “9 This limitation on extending the three year period also applies to mortgages in foreclosure under §125i1 of TILA 15 U. I’m so glad I consolidated my loans and will never go back to the payday loan store ever again”. Most have a gateway to paying online. We are dedicated to responsible lending practices and exceptional customer support. Speedy Cash engages in the money transmission and/or currency exchange business as an authorized delegate of MoneyGram Payment Systems, Inc. This kind of credits can reach a loan quote of 300000 rands and, the repayment term can be from 1 month to 60. Residents of certain states, including, but not limited to Arkansas, New York, Vermont, West Virginia, Washington, and Pennsylvania, are not eligible to utilize this website or its service.

Equipment Financing

That’s a problem for borrowers because lenders can charge additional finance charges each time you roll over a loan. Borrow: £500 over 16 weeks. One common credit scoring myth is that once an account is closed, it won’t impact your credit scores. Some of the offers on this page may not be available through our website. 28, Total Interest: £428. Simply click Apply Now, and you will need to fill in a few details and then submit the application to us. Banks With Free Checking. As a result, borrowers are often unable to pay their loans in full. Click continue to proceed or click the “x” to stay on this site. You can cancel a Direct Debit by contacting your bank or building society, or through your online banking app. Assumes a 14 day term. 1 Additional repayments made on a Fixed Rate Loan are not available to be redrawn. App Store is a service mark of Apple Inc. How much would you like to borrow.

Loan Details

Learn more from reviews of LendingPoint personal loans. That SSN of yours is real and active. Instant Funding Your Money. OACCs have been designed for consumers who. 00% balance transfer promotion for 10 months, so even if you’re after cash, you can still access it as long as you have debt on another credit card. Tags: Finance My Business. Please choose an option—AmericasEuropeMiddle EastAsiaAfricaOther. Only available at iCASH. OSFI expects FRFIs to verify that their residential mortgage operations are well supported by prudent underwriting practices, and have sound risk management and internal controls that are commensurate with these operations. Many people have this common misconception about a personal loan that it is expensive and offers unfair interest charges to its customers. Official websites use. They are also tasked with checking if the client’s business or purpose to be funded has the financial ability to generate adequate cash flows to service the debt and provide the borrower with an income. Both are installment loans, but federal loans are typically much more lenient. Find out more about personal installment loans and how they work. It means that they will accept a credit score as low as 300 points or even a high debt to income ratio, as long as you have a solid verifiable income source. HTTPS rather than through to the Url was a guarantee of your protection of one’s analysis that’s common. What is a Pre Approval Letter. Plus, many personal installment lenders will offer a better customer experience than your average small dollar lender. Payday loans are most commonly taken out when cash is needed quickly in between pay cheques to make ends meet. Munn if a financial lifeline that they rely on is cut off. If you have property, you can try to rent it to turn it into additional income. Your ABA/Routing number can be found on most bank statements as well as on the bottom of your checks. You will also have to have earned less than £2,600 in the six months prior to making your application. Lender credits are worth noting if you don’t have the cash to pay closing costs for a home purchase or refinance. Representative example: Borrow £700 for 6 months. » MORE: Compare cash advance apps. For instance, a first time client may need assistance on the application process or some advice regarding what loans to apply for and their eligibility for such loans. 00 verification fee per transaction. Representative Example: £1,200 borrowed for up to 75 days.

Enhanced Content Go to Date

Ability to repay analysis with income documentation required. The interest rates on title loans are often very high, which can make it difficult for borrowers to repay the loan. It can remarkably work for you even if you have bad credit. Just get in contact with your Customer Care Manager and we’ll provide an early settlement figure. Wie verdient man Geld. Loan will only be available to residents in those states where permitted by law and based on applicant’s creditworthiness. The repayment terms for personal loans usually range from 24 months to 60 months, but some can go as high as 72 months. 30% origination fee of $711, for an APR of 15. If you choose a high interest loan, reduce your finance charges by paying more than the minimum installment payment. Understanding the differences between the two types of loans is necessary before deciding to optimize one’s financial situation. One way to make sure your payments are on time is to set up autopay. Emergency loans are listed on page 1 of the Courier /FastTrack. Others might simply use a personal loan to fund a dream wedding or once in a lifetime vacation. Emerging financing options like “buy now, pay later” and cash advance apps, which give access to cash without a hard credit inquiry, are alternatives to no credit loans. Last updated on April 3, 2023. If you’re self employed and match the qualifications, you can apply for an installment loan with no credit check. The better your credit score, the better your chances are. Borrower completes a loan application and applies for a loan at a bank or alternative lender. This means they should check certain things and give you certain information before lending to you. The Resource Conservation and Recovery Act, as amended 42U. We’re fast, easy and headache free. In the USA, all lenders are legally required to carry out credit checks on applicants.